Feie Calculator Fundamentals Explained

Table of Contents10 Simple Techniques For Feie CalculatorFeie Calculator for BeginnersThe Basic Principles Of Feie Calculator The smart Trick of Feie Calculator That Nobody is Discussing5 Easy Facts About Feie Calculator Described

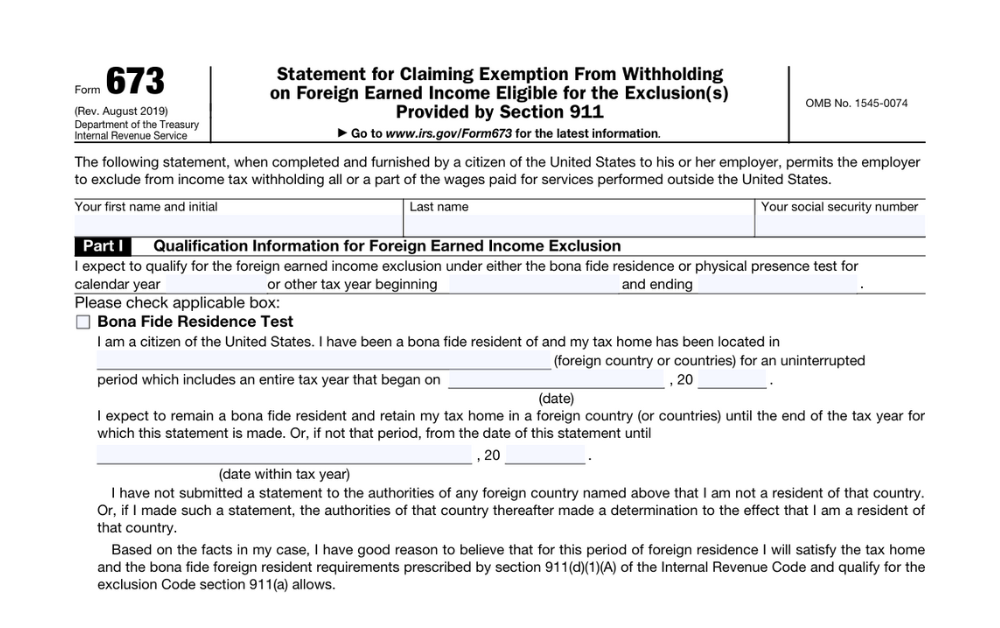

He offered his U.S. home to develop his intent to live abroad permanently and applied for a Mexican residency visa with his partner to assist meet the Bona Fide Residency Test. In addition, Neil safeguarded a long-lasting home lease in Mexico, with strategies to at some point buy a property. "I presently have a six-month lease on a home in Mexico that I can prolong another 6 months, with the intent to buy a home down there." Neil directs out that buying residential property abroad can be testing without very first experiencing the area."We'll definitely be outdoors of that. Even if we come back to the United States for doctor's consultations or service calls, I question we'll invest more than thirty day in the US in any provided 12-month duration." Neil highlights the value of strict monitoring of united state visits (Foreign Earned Income Exclusion). "It's something that individuals require to be actually thorough regarding," he says, and recommends expats to be mindful of typical mistakes, such as overstaying in the U.S.

Getting The Feie Calculator To Work

tax obligation obligations. "The reason U.S. taxation on globally income is such a big deal is because many people neglect they're still subject to united state tax obligation also after transferring." The united state is among minority nations that taxes its people no matter of where they live, meaning that even if a deportee has no revenue from united state

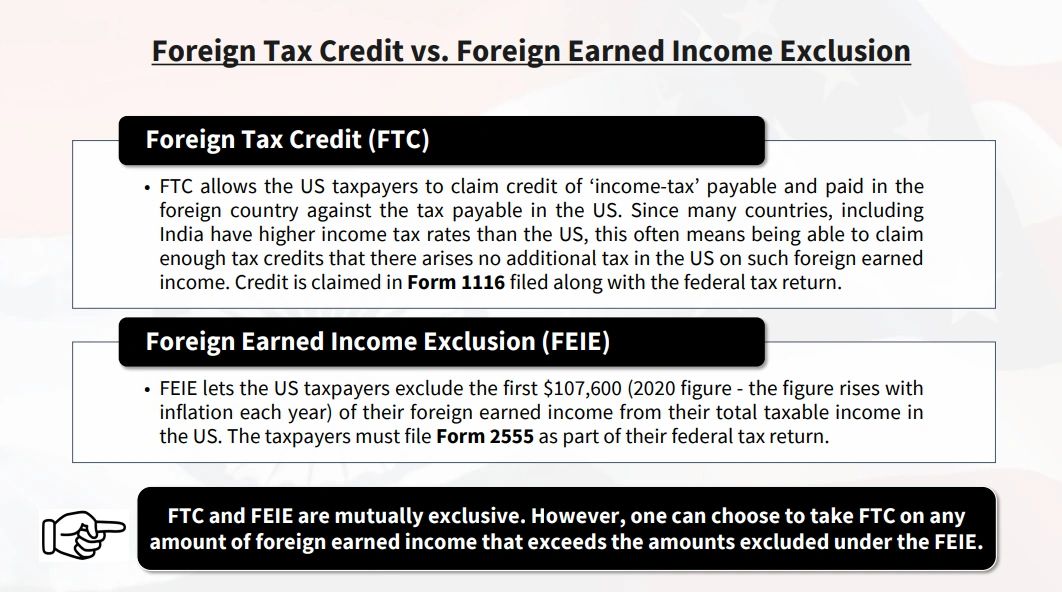

tax obligation return. "The Foreign Tax obligation Debt permits individuals functioning in high-tax nations like the UK to counter their U.S. tax obligation obligation by the quantity they've currently paid in taxes abroad," says Lewis. This makes sure that deportees are not exhausted twice on the exact same revenue. Nonetheless, those in low- or no-tax countries, such as the UAE or Singapore, face added obstacles.

How Feie Calculator can Save You Time, Stress, and Money.

Below are a few of one of the most frequently asked inquiries about the FEIE and various other exemptions The International Earned Revenue Exemption (FEIE) permits united state taxpayers to leave out up to $130,000 of foreign-earned earnings from government income tax, lowering their united state tax obligation liability. To get approved for FEIE, you have to meet either the Physical Presence Examination (330 days abroad) or the Authentic House Examination (confirm your key house in a foreign nation for a whole tax year).

The Physical Presence Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Test additionally calls for united state taxpayers to have both an international earnings and an international tax obligation home. A tax home is defined as your prime location for business or employment, despite your household's home.

The Feie Calculator Diaries

A revenue tax treaty between the U.S. and an additional nation can help stop dual taxation. While the Foreign Earned Income Exclusion lowers gross income, a treaty might offer added benefits for eligible taxpayers abroad. FBAR (Foreign Financial Institution Account Record) is a called for declare U.S. people with over $10,000 in foreign economic accounts.

Qualification for FEIE depends on conference certain residency or physical existence tests. He has over thirty years of experience and currently specializes in CFO solutions, equity payment, copyright taxation, marijuana taxes and separation relevant tax/financial planning matters. He is a deportee based in Mexico.

The foreign earned revenue exclusions, sometimes referred to as the Sec. 911 exemptions, exclude tax obligation on incomes earned from functioning abroad.

Feie Calculator for Beginners

The tax benefit excludes the income from tax at bottom tax obligation prices. Formerly, the exemptions "came off the top" lowering revenue topic to tax at the leading tax obligation prices.

These exemptions do not excuse the earnings from US tax but merely provide a tax decrease. Keep in mind that a single person working abroad for every one of 2025 who made concerning $145,000 without other earnings will certainly have gross income decreased to zero - efficiently the very same solution as being "free of tax." The exclusions are computed every day.

Comments on “9 Simple Techniques For Feie Calculator”